A new annual survey has revealed a significant acceleration in AI adoption among firms within the Dubai International Financial Centre (DIFC), with 52% of authorised firms now integrating the technology, a sharp increase from 33% in 2024. The report, conducted by the Dubai Financial Services Authority (DFSA), highlights rapid technological integration alongside emerging challenges in governance and risk management.

The survey, which engaged 661 authorised firms and achieved an 88% participation rate, found that 345 firms are now actively using AI, nearly double the 177 reported in the previous year. The forward-looking sentiment is equally strong, with 60% of respondents expecting to increase their AI usage over the next 12 months and 75% planning to do so over the next three years.

Generative AI Leads the Charge

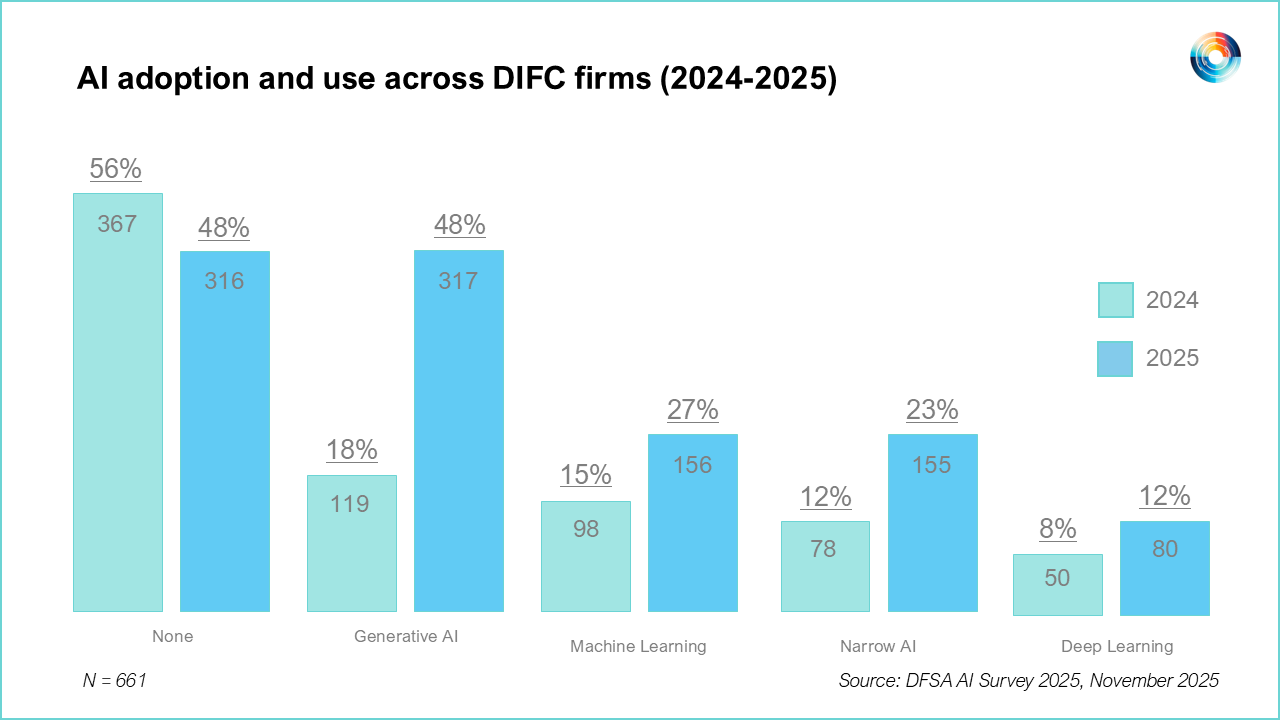

The most dramatic growth was observed in the adoption of Generative AI, which saw a staggering 166% increase over the last 12 months. According to the DFSA survey, 48% of firms now utilise Generative AI, up from just 18% in 2024.

This surge was followed by significant growth in other AI categories. Narrow AI adoption grew by 99% year-on-year, while the use of deep learning and machine learning both climbed by more than 60%. This data underscores a broad-based move across the financial sector to leverage different facets of AI for operational efficiency and innovation.

Governance Lags Behind Adoption

While technological deployment is advancing rapidly, the development of corresponding governance frameworks appears to be moving at a slower pace. The survey identified a potential gap between technology adoption and risk management maturity, finding that 21% of firms using AI still lack clear accountability or oversight mechanisms.

This is a critical concern, particularly for firms deploying AI in business-critical operations. The findings suggest an urgent need for companies to bolster their internal governance to manage the risks associated with this powerful new technology.

Internal Focus and a Call for Clarity

The majority of AI applications remain focused on internal operations. The report indicates that 79% of all use cases are directed at functions such as human resources, legal, finance, compliance, and risk management. In contrast, only 109 firms, or 21% of those using AI, are deploying it in external, client-facing applications.

Furthermore, most firms are still in the early stages of their AI journey, concentrating on proof-of-concept initiatives and pilot programs rather than full-scale implementation. As companies move to scale these pilots, they are calling for greater regulatory clarity. Survey participants expressed a desire for more detailed guidance on AI governance, ethical use, and supervisory expectations, including a harmonisation of regulations across the UAE’s financial sector.

About Dubai International Financial Centre (DIFC)

The Dubai International Financial Centre (DIFC) is a leading financial hub in the Middle East, Africa, and South Asia (MEASA) region. It is a purpose-built financial free zone in Dubai with an independent regulator, the Dubai Financial Services Authority (DFSA), which oversees a wide range of financial services including asset management, banking, securities, insurance, and Islamic finance.

Source: Middle East AI News