The Middle East is poised to become the world’s fastest-growing data centre region, with a new report from global property consultancy Knight Frank forecasting a staggering 62.5% compound annual growth rate (CAGR) over the next two years. This explosive growth, driven by gigawatt-scale projects in Saudi Arabia and the UAE, signals the region’s rapid shift from cloud infrastructure catch-up to becoming a leader in AI-first deployment.

A Monumental Leap in Capacity and Valuation

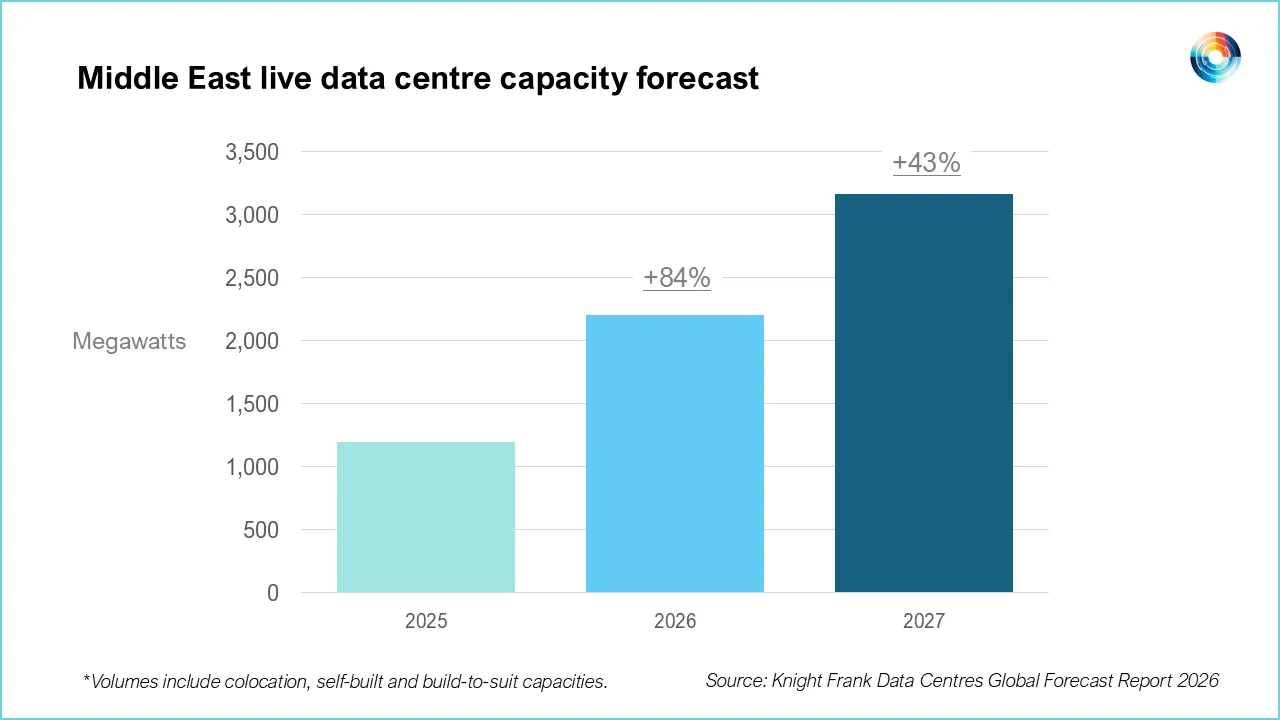

According to the Global Data Centres Outlook 2026 report, the region’s data centre capacity is projected to surge from 1.2 Gigawatts (GW) at the end of 2025 to 3.2GW by 2027. This expansion is expected to fuel a dramatic increase in market value, with the combined Saudi and UAE markets climbing from an estimated $35 billion in 2025 to $115 billion by the end of 2027.

This growth rate dwarfs other major global hubs, far outpacing North America’s 24.6% and Europe’s 17.8% projected expansion. The increase in market valuation reflects not just the additional capacity but also the premium pricing commanded by advanced, AI-optimised infrastructure.

Abu Dhabi and Riyadh Lead the Charge

Abu Dhabi is set to become the region’s first gigawatt market by 2027, joining an elite group of only 20 such markets globally. This is largely powered by the USA-UAE AI initiative, which is developing a 5GW multi-tenanted campus. A key project within this campus is Stargate UAE, a 1GW AI compute cluster operated by OpenAI and Oracle, which will see its first 200MW go live in 2026.

Meanwhile, Riyadh is projected to scale at an even faster compound annual growth rate of 85.9% over the next two years. Over half a gigawatt of new capacity is expected before 2028, spearheaded by the PIF-owned AI company HUMAIN, which has ambitious targets of reaching 1.9GW by 2030.

A Reality Check on Aspirational Goals

While recent announcements have touted over 14GW of new data centre developments in the region, the Knight Frank analysis offers a more conservative outlook. The report suggests that a realistic total supply will more likely be around 5GW by the end of the decade, indicating a significant risk of market oversupply if all announced projects were to materialize without sufficient demand.

Global Context and Challenges

Globally, 33GW of new data centre capacity is expected over the next two years. However, the industry faces three major challenges. Power availability is emerging as the primary constraint, particularly in Europe and APAC. Furthermore, the capital-intensive nature of AI-ready infrastructure creates liquidity pressures, while rapid technological advancements raise concerns about the adaptability of new sites and the risk of older facilities becoming stranded assets.

About Knight Frank

Knight Frank LLP is a leading independent global property consultancy headquartered in London. It provides residential and commercial property advisory services, consultancy, and transactional support to a wide range of clients, including individual owners, buyers, developers, investors, and corporate tenants.

Source: Middle East AI News