Lean Technologies, a leading financial infrastructure provider in the MENA region, has officially graduated from the Central Bank of the UAE’s (CBUAE) Open Finance live-proving program. This achievement makes Lean one of the first Third Party Providers (TPPs) to reach this significant milestone under the national Open Finance Framework.

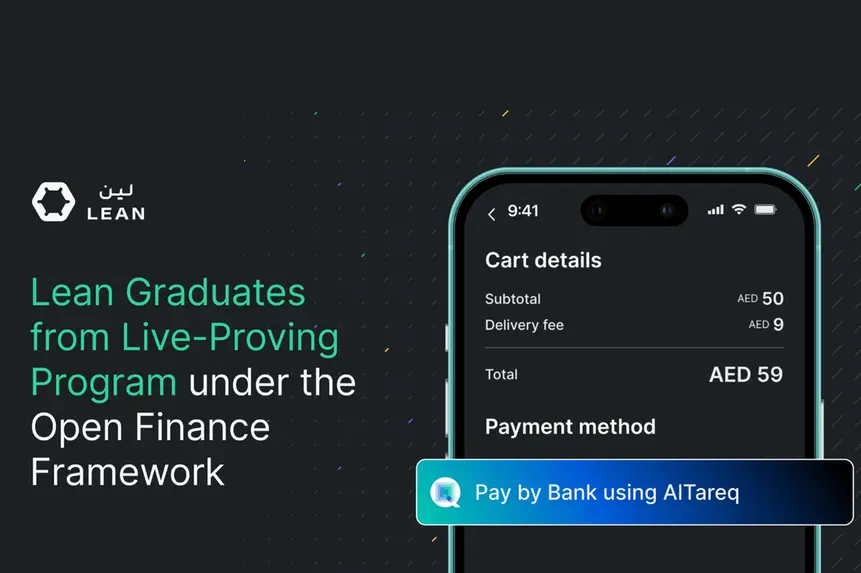

The graduation marks a critical step in the UAE’s transition from preparing for Open Finance to actively executing it. Lean is now connected to Commercial Bank of Dubai (CBD), enabling live Open Finance payment use cases and consent-driven access to financial data through a regulated and secure infrastructure.

A Milestone for UAE’s Digital Economy

Lean’s graduation confirms its technical and operational maturity, positioning the company at the forefront of supporting banks and businesses as Open Finance moves into live operation. The UAE’s Open Finance Framework is a cornerstone of the country’s digital economy strategy, designed to foster innovation through regulated data sharing and advanced payment experiences.

This development signals growing readiness across the ecosystem as the framework moves into its next phase, with Lean set to play a key role in its adoption and expansion.

Proving Technical and Operational Maturity

During the Live Proving phase, Lean worked closely with banks and ecosystem partners to meet the stringent regulatory, technical, and operational requirements established by the CBUAE. With this phase complete, Lean is prepared to help clients build and deploy a new generation of solutions powered by secure, consent-driven data access and payment initiation.

“This is a defining moment for Open Finance in the UAE, and for Lean,” said Tewfik Cassis, CPO at Lean Technologies. “Being among the first TPPs to graduate from Live Proving reflects years of investment in infrastructure, compliance, and ecosystem collaboration. It also puts Lean in a strong position to help businesses move quickly as Open Finance adoption accelerates.”

Lean will continue its collaboration with banks, regulators, and partners to expand use cases and help establish Open Finance as a foundational layer of the UAE’s financial architecture.

About Lean Technologies

Lean Technologies is the leading financial infrastructure provider in the MENA region, empowering businesses to access financial data and initiate payments through a single, secure platform. Since its founding in 2019, Lean has supported more than 350 companies, processed over $4 billion in transaction volume, connected upwards of 2 million accounts, and facilitated more than 3 million account verifications.

Source: Zawya