Egyptian asset management firm Mubasher Capital is preparing to launch the country’s first silver investment fund, signaling a significant expansion of commodity-based financial products in the local market. The company submitted the required documents to the Financial Regulatory Authority (FRA) earlier this week, according to Vice Chairman Ehab Rashad.

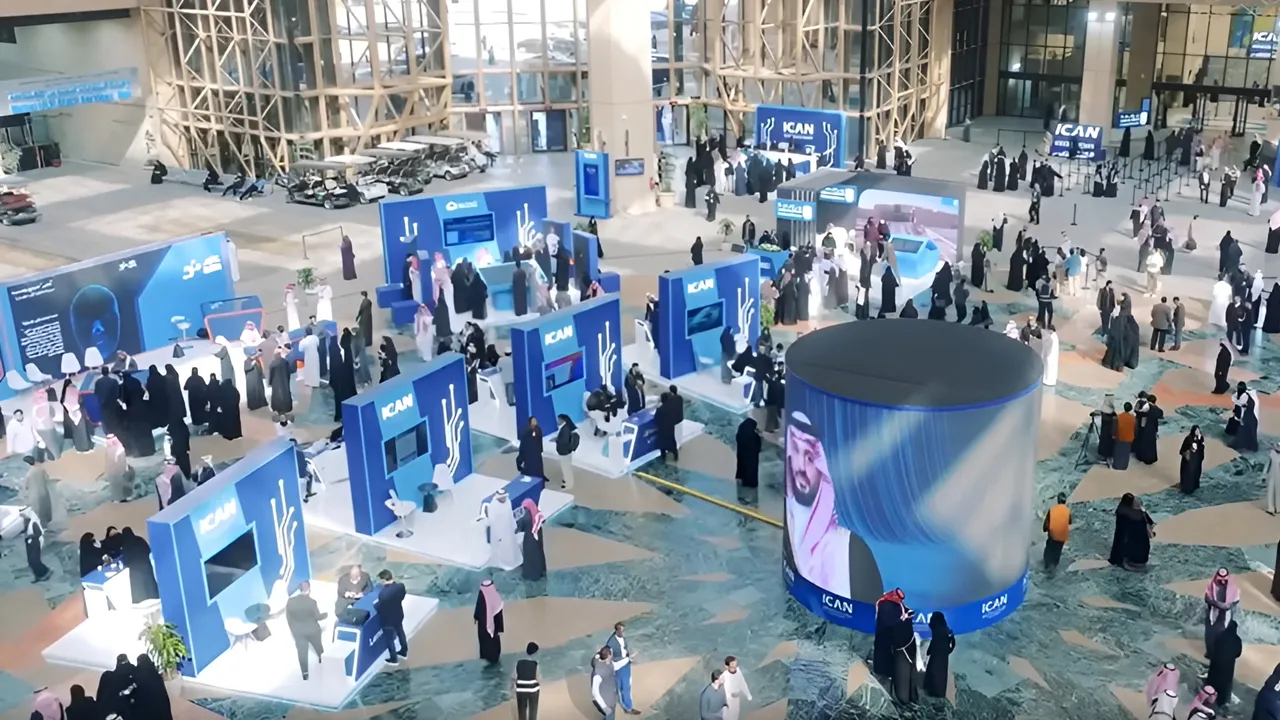

Rashad revealed the details to Zawya Arabic on the sidelines of a conference in Cairo, expressing the firm’s ambition to pioneer this new investment vehicle.

A EGP 2 Billion Target for the Silver Fund

Mubasher Capital has set an ambitious target size of 2 billion Egyptian pounds ($42.6 million) for the new fund. While a specific launch date has not been announced pending regulatory approval, the initial capital for the fund is set at EGP 10 million.

“We hope to be the first silver fund in Egypt. The target size for the fund is 2 billion Egyptian pounds,” Rashad stated.

Once approved, subscriptions will be available through four Egyptian firms: Mubasher Capital, Ostoul Capital, Arabeya Online, and Zaldi Investments.

Riding the Wave of Commodity Investment in Egypt

The move into silver comes as demand for commodity-focused funds rises in Egypt, driven by climbing metal prices and easing interest rates. The market already features several active gold investment funds, and Mubasher Capital’s initiative indicates a growing investor appetite for diversifying into other precious metals.

This new fund is part of a broader product expansion for the firm. Mubasher Capital is also developing a dollar-denominated fund and another fund designed to track the EGX35-LV, Egypt’s low-volatility equity index.

A Strategic Partnership with Empire of Gold

The silver fund will be established through a strategic partnership between Mubasher Capital and Empire of Gold, an Egyptian gold investment company. Under the agreement, Mubasher Capital will hold a majority 70% stake, with Empire of Gold holding the remaining 30%.

About Mubasher Capital

Founded in 2018, Mubasher Capital Egypt is an asset management company operating in securities trading and the management of investment funds and portfolios. The firm currently manages three investment funds, including an equity fund, a fixed-income fund, and a gold fund. It is part of the Bahrain-based Mubasher Group, which was established in 2007.

Source: Zawya