The Dubai International Financial Centre (DIFC) has announced record-breaking annual results for 2025, demonstrating significant double-digit growth across key metrics including company registrations, revenue, and net profit. The results solidify its position as a leading global financial hub and a critical driver of the region’s economic landscape.

Record Financials and Company Growth

DIFC reported a 20 percent increase in combined revenues, reaching Dhs2.13 billion ($580 million) in 2025, up from Dhs1.78 billion in the previous year. Net profit saw an even steeper rise, climbing 28 percent to Dhs1.48 billion from Dhs1.16 billion in 2024.

This financial success was mirrored by a surge in new companies joining the centre. The number of organically acquired active companies grew by 28 percent year-on-year to a total of 8,844. In 2025 alone, DIFC welcomed 2,525 new company registrations, marking a remarkable 39 percent increase from the prior year.

“DIFC’s progressive legal and regulatory framework forms decisive pillars that support the phenomenal growth achieved by the Centre in 2025,” said Essa Kazim, Governor of DIFC. “Such incremental growth contributes significantly to Dubai’s economy and enhances the emirate’s stature as a leading global financial centre.”

A Magnet for Global Financial Giants

The centre continues to attract top-tier global firms, with notable new entrants in 2025 including Allianz Trade, Cambridge Associates, China International Capital Corporation, ICICI Asset Management, Manulife, National Bank of Kuwait, PIMCO, Starwood Capital, and Warburg Pincus.

DIFC’s ecosystem now hosts over 1,052 financial services firms. The wealth and asset management sector saw particular strength, with the number of firms growing by 22 percent to over 500, including 102 hedge funds. The centre is also a preferred destination for private wealth, with the number of family-related entities rising by 61 percent to 1,289.

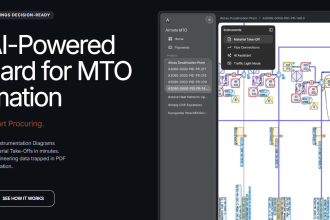

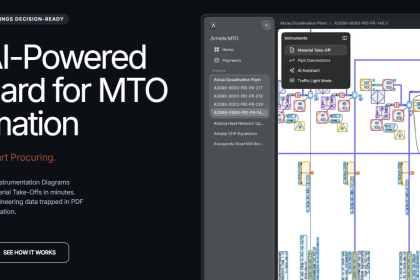

Innovation Ecosystem Fuels Startup Growth

Reinforcing Dubai’s status as a top-four global fintech hub, DIFC’s innovation ecosystem experienced substantial expansion. The number of AI and fintech companies based in the centre increased by 35 percent to 1,677. This includes 200 AI firms located at the dedicated Dubai AI Campus.

Critically for the region’s founders and VCs, startups supported by DIFC’s innovation platforms have collectively raised more than $4.5 billion regionally.

“DIFC’s record performance in 2025 demonstrates unprecedented growth, at a time when the evolution of global finance is moving to new horizons,” stated Arif Amiri, Chief Executive Officer of DIFC Authority.

Expanding Talent Pool and Infrastructure

The growth in companies has translated directly into job creation. Employment within DIFC grew by 9 percent, with 4,122 new jobs created in 2025, bringing the total workforce to 50,200 professionals. Women constitute 36 percent of this workforce.

To accommodate the continued demand, construction is underway for 1.7 million square feet of commercial space. The newly announced Zabeel District expansion is set to add a further 17.7 million square feet of mixed-use space, underscoring DIFC’s long-term strategic growth plans.

About Dubai International Financial Centre (DIFC)

The Dubai International Financial Centre (DIFC) is one of the world’s most advanced financial centres, and the leading financial hub for the Middle East, Africa and South Asia (MEASA) region. With a vibrant community of over 50,000 professionals working across more than 8,800 active registered companies, DIFC is a global hub for business, fintech, and lifestyle. It features an independent regulatory and judicial system, a global financial exchange, and a dynamic business environment.

Source: Gulf Business