e& money, the fintech arm of e&, has announced it has received a Finance Company license from the Central Bank of the UAE, signaling a significant expansion of its services. The move allows the digital payments platform to evolve beyond transactions and enter the lending market, aiming to enhance financial inclusion across the Emirates.

From Payments Powerhouse to Lending Pioneer

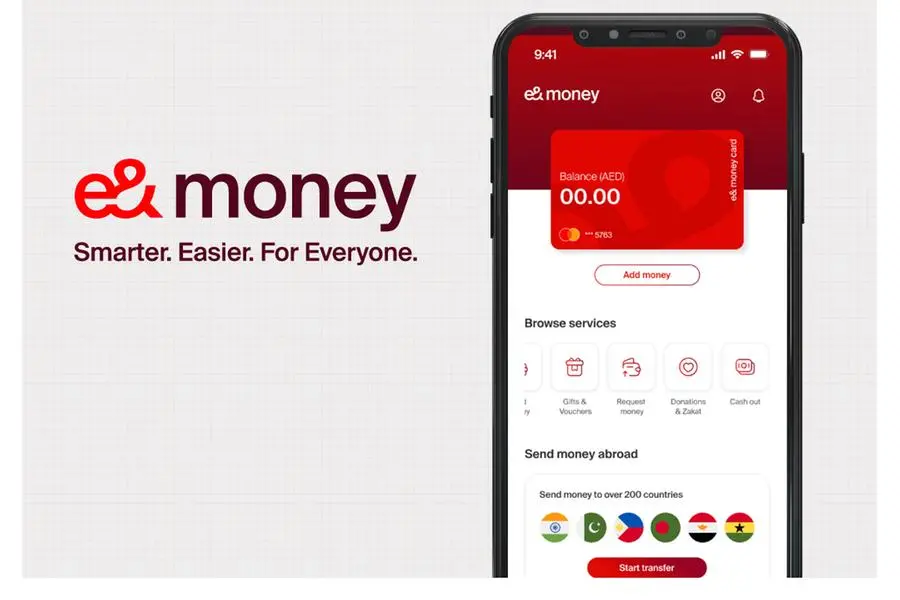

With a user base of over 2 million customers, e& money has established itself as one of the UAE’s most inclusive digital payment ecosystems. The platform has become a key tool for everyday payments, international remittances, and card spending. This new license marks a strategic shift, leveraging its scale, user trust, and data intelligence to move into the lending sector.

The company plans to integrate credit services directly into its existing digital-first environment. This evolution is designed to provide financial opportunities to individuals and segments that have been historically underserved by traditional banking and lending models.

A Data-Driven Approach to Financial Inclusion

At the core of this new venture is a data and AI-driven approach to credit assessment. By analyzing real transaction behavior, alternative data, and advanced analytics, e& money has developed a proprietary credit scoring model. This model is designed to responsibly extend credit access to new segments of society, including those who may not have been previously eligible for conventional loans.

Khalifa Al Shamsi, CEO of e& life and e& international, commented on the strategic move: “In a digitally advanced economy like the UAE, access to credit is still not a given. While the UAE has achieved near universal financial inclusion, gaps remain when it comes to conventional lending. At e& money, we believe its about facilitating access this is not a risk issue — it’s an access issue. With this next chapter, we are rethinking how credit is assessed and delivered, using data and technology to open doors for people who have long been overlooked.”

Expanding the Financial Superapp Vision

The introduction of lending services reinforces e& money’s ambition to become a comprehensive financial superapp. The company will progressively roll out a range of lending solutions in stages, including buy-now-pay-later (BNPL) offerings, early wage access, and credit cards.

These products are being designed with a focus on transparency, affordability, and strong customer protection, aiming to support users throughout their complete financial journey, from daily transactions to moments of growth and stability.

About e& money

e& money is the fintech arm of e&, serving over 2 million customers in the UAE. It offers a digital financial services platform for payments, international remittances, and card spending. With its new Finance Company license, it is expanding its offerings to include a range of data-driven lending products to promote financial inclusion.

Source: Zawya