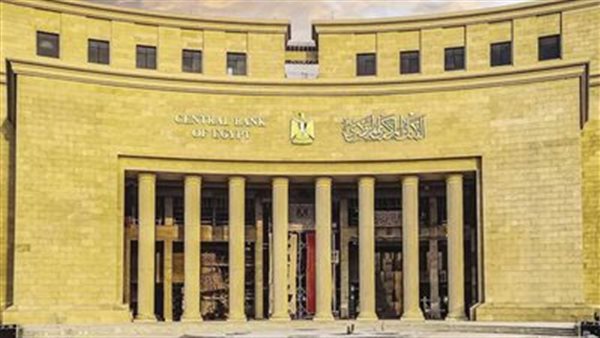

- The Central Bank of Egypt’s Nilepreneurs initiative has successfully facilitated access to EGP 19 billion in financing for over 14,000 projects, marking a significant milestone in the country’s support for small and medium-sized enterprises (SMEs). This financial injection was complemented by over 1.16 million non-financial and advisory services delivered to approximately 502,000 clients, including a notable 210,000 women entrepreneurs.

The initiative, which leverages a partnership with 18 banks, provides a comprehensive suite of consulting services designed to prepare projects for funding and enhance their capacity for growth and competition in the market.

A Catalyst for SME Growth

Since its acceleration in 2020, the initiative’s Business Development Services (BDS) centers have witnessed remarkable expansion. The volume of services delivered has grown at an average annual rate of 135%, while the number of clients served has increased by 125% annually.

This impressive growth is supported by a robust physical network of 132 BDS centers strategically located across 25 governorates, ensuring wide geographical coverage and accessibility for entrepreneurs throughout Egypt.

Comprehensive Support Beyond Capital

Nilepreneurs’ BDS centers offer an integrated package of non-financial and advisory services entirely free of charge. This support system guides entrepreneurs through every stage of their business journey, from vetting viable project ideas and assisting with company registration to preparing economic feasibility studies and detailed financial analyses.

The centers also play a crucial role in preparing credit files, connecting businesses with suppliers, opening new markets, and providing essential training to elevate the skills of entrepreneurs and their teams. This holistic approach aims to formalize businesses and integrate them into the official economy, aligning with Egypt’s Vision 2030 for sustainable development and economic empowerment.

About Nilepreneurs

Nilepreneurs is a national initiative launched by the Central Bank of Egypt to foster a supportive ecosystem for startups and SMEs. Operating through a widespread network of Business Development Services (BDS) hubs hosted in banks, universities, and youth centers, the initiative provides free financial and non-financial services to empower entrepreneurs, drive economic growth, and encourage the transition of businesses from the informal to the formal sector.

Source: Cairo 24