In a historic milestone for the technology sector, Nvidia has become the first public company to surpass a $5 trillion market capitalization, cementing its position as the primary beneficiary of the global artificial intelligence boom. The chipmaker’s shares surged over 5.6% on Wednesday, driven by a series of high-impact announcements and sustained, insatiable demand for its advanced graphics processing units (GPUs).

Unprecedented Growth Fueled by AI Demand

Nvidia’s ascent has been remarkably swift, reaching the $5 trillion mark just three months after crossing the $4 trillion threshold. The company’s stock has soared by more than 50% this year alone, a testament to the critical role its GPUs play in powering data centers for training large language models, inference, and other resource-intensive AI applications. The scarcity and unparalleled performance of its chips have allowed Nvidia to command the market, effectively shaping the infrastructure of the new AI-powered economy.

Catalysts Behind the Latest Surge

Recent developments have further bolstered investor confidence. The stock’s latest climb was partly fueled by news that U.S. President Donald Trump expects to discuss Nvidia’s powerful Blackwell chips with Chinese President Xi Jinping. This was compounded by CEO Jensen Huang’s projection of $500 billion in future AI chip sales and the announcement that Nvidia is building seven new supercomputers for the U.S. government. Furthermore, the company revealed a $1 billion investment in Nokia to develop AI-native 5G-Advanced and 6G networks, signaling its expansion into next-generation telecommunications.

Strategic Investments and Market Influence

Nvidia’s market influence extends beyond chip sales. The company is at the heart of multi-billion-dollar deals to expand the global data center capacity required for advanced AI models. In a significant move, Nvidia announced a planned investment of up to $100 billion in OpenAI, another leader in the AI space. This collaboration aims to deploy 10 gigawatts of Nvidia systems to power OpenAI’s future innovations, highlighting Nvidia’s role as a kingmaker in the AI ecosystem. With its current valuation, Nvidia is now worth more than the aggregated stock markets of every country except for the United States, China, and Japan.

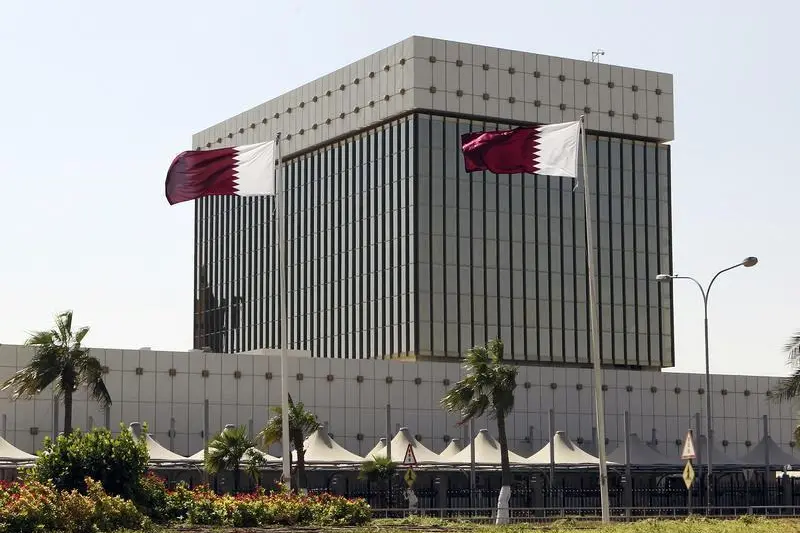

Implications for the MENA Tech Ecosystem

Nvidia’s monumental valuation has profound implications for the rapidly evolving MENA tech landscape. As nations like Saudi Arabia and the UAE aggressively pursue sovereign AI capabilities and economic diversification, access to high-performance compute has become a strategic imperative. The insatiable demand for Nvidia’s GPUs underscores the critical importance of securing chip supply chains for regional data center projects and national AI initiatives. For MENA startups, particularly in the AI sector, the high cost and scarcity of these essential GPUs present both a challenge and an opportunity, potentially driving innovation in algorithmic efficiency and fostering partnerships with the tech giant to gain access to necessary infrastructure.

About Nvidia

Nvidia is a global technology company known for inventing the graphics processing unit (GPU). The company’s work in accelerated computing and artificial intelligence is reshaping trillion-dollar industries, such as gaming, professional visualization, data centers, and transportation. Nvidia’s platforms and products are widely used to power AI, data science, and high-performance computing.

Source: TechCrunch