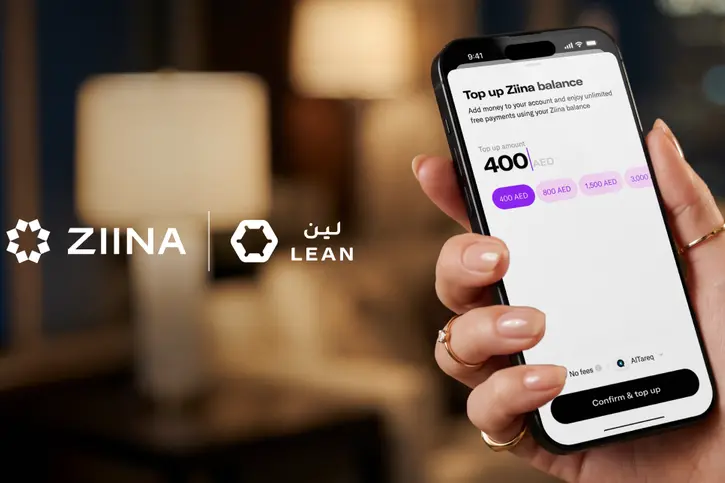

In a landmark move for the UAE’s financial sector, homegrown payments platform Ziina and financial infrastructure provider Lean Technologies have announced the launch of the country’s first live, customer-initiated Open Finance payment experience. This development operates under the Central Bank of the UAE’s (CBUAE) official Open Finance framework, signaling a major step forward in the region’s fintech evolution.

With this launch, Ziina users can now execute instant, direct account-to-account bank payments from within the app. The new feature leverages regulated Open Finance APIs to connect directly to a user’s bank account, providing a more secure, transparent, and seamless method for transferring money without navigating away to other banking channels or performing manual transfers.

A New Era for UAE Payments

This milestone marks the transition of Open Finance in the UAE from a theoretical concept to a practical, real-world application. It validates that regulated API connectivity can reliably support production-grade payment flows, paving the way for wider adoption and innovation.

The new payment experience is built on the robust regulatory and technical foundation established by the CBUAE. This includes the UAE’s Open Finance Regulation, the national Open Finance platform Nebras, and the Central Bank’s API framework, Al Tareq, which together enable secure, consent-based services that foster greater competition and customer choice.

The Technology Behind The Milestone

The collaboration leverages the distinct strengths of both fintechs. Lean Technologies provides the regulated Open Finance infrastructure, ensuring secure connectivity, compliant payment initiation, and enterprise-grade resilience.

Ziina, a licensed financial institution (LFI), focuses on the customer experience, designing a smooth payment flow that meets modern consumer expectations for instant, predictable, and trustworthy transactions.

Leadership Commentary

Faisal Toukan, Co-founder and CEO of Ziina, highlighted the significance of the achievement, stating, “Delivering the UAE’s first customer-initiated Open Finance payment marks an important step for the country’s financial ecosystem. Regulated, API-driven payments, now operating at production scale, are beginning to influence expectations around speed,transparency and trust. Enabling customers to complete a bank payment directly inside the Ziina app through Open Finance reflects how forward-thinking policy can shape everyday financial behaviour.”

Hisham Al-Falih, CEO of Lean Technologies, commented on the market impact, “Seeing Open Finance payments live in the UAE is a meaningful moment for the market. This milestone reflects the Central Bank’s vision for modern, secure financial infrastructure and shows what becomes possible when strong connectivity meets thoughtful product execution. Ziina has been an exceptional partner, and we are proud to enable the country’s first live Open Finance payment experience.”

About Ziina

Founded in 2020 by Faisal, Sarah, and Talal Toukan, Ziina is a UAE-based licensed fintech platform for consumers and businesses. It provides a fast and secure way to spend, receive, and manage money through services like instant transfers, payment links, QR code payments, and the Ziina Card. Licensed by the Central Bank of the UAE, Ziina serves over 260,000 users with a mission to enable financial freedom across the Arab World.

About Lean Technologies

Lean Technologies is the leading financial infrastructure provider in the MENA region, empowering businesses to access financial data and initiate payments through a single, secure platform. Since its founding in 2019, Lean has supported more than 350 companies, processed over $4 billion in transaction volume, and connected upwards of 2 million accounts. The company plays a foundational role in building Open Finance infrastructure across the UAE in alignment with the Central Bank’s Financial Infrastructure Transformation programme.

Source: Zawya